Are RRSP’s a Scam?

Are RRSP’s a Scam?

Don’t Invest In RRSP’s THEY ARE A SCAM!!!

I hear this a lot when I talk to folks about their investments. Individuals shaking their fists at the idea of contributing to a Registered Retirement Savings Plan (RRSP), absolutely convinced it’s a scam. “I wish I NEVER would have invested in RRSP’s!” they say — “RRSP’s are a scam! They tax you SO MUCH when you pull it out!”

These folks, nice as they are, hit retirement and they find themselves grappling with tax burdens when they withdraw funds from their RRIF’s— and no one likes to pay tax. Yet, amidst their frustration and disappointment, there’s a number of critical things these fine folks have forgotten about. The initial tax deductions they received for their contributions, leading to years of tax refunds, and the years of tax-deferred growth their investments quietly accumulated. It’s really a story of misunderstood benefits.

If You Like My Writing— YOU WILL LOVE ME ON YOUTUBE! SUBSCRIBE TO ME TODAY?

Let’s Take a CLOSER LOOK Shall We?

In this article, we’re diving deep into the world of RRSP investing to finally put to rest these misconceptions and reveal the untapped potential within. We’ll shine a light on why RRSPs are far from a scam but instead represent a strategic financial move that can lay the groundwork for a more secure and prosperous retirement.

So, let’s set the record straight and explore 5 reasons why RRSP investing is not just a wise choice but an essential one for anyone looking to build a brighter financial future.

1) You Can Immediately LOWER you Taxable Income

The benefit of making contributions to an RRSP is instant tax benefits. You can deduct the amount you contribute to your RRSP from your annual taxable income. As a result, you immediately pay less in taxes. It’s similar to receiving a tax break for retirement savings. As a result, you are keeping more of your money in your pocket now in addition to setting money aside for the future.

2) You Can Potentially Withdraw Your Funds Later At A Lower Tax Rate

Withdrawals from RRSPs typically happen during retirement when people are in lower tax brackets. This means they can pay less tax on the money they withdraw compared to when they were working and contributed to the RRSP. This lower tax impact helps retirees manage their finances better, making their retirement savings stretch further. In essence, RRSPs allow individuals to keep more of their hard-earned money when they need it most, at retirement.

3) Creditor Protection

RRSPs can offer protection from creditors. In certain situations, the money you have saved in your RRSP is shielded from creditors, giving you added security. This means that if you face financial difficulties or legal issues, your RRSP savings are safe from being taken to pay off debts. Having a safety net for your retirement funds helps ensure that they are there for you when you need them the most.

ENJOYING THIS CONTENT? Three Words And Small SHAMELESS Ask For the Medium Algorithm.. CLAP, COMMENT, HIGHLIGHT!

Clap Comment Highlight!

Dear Loyal Followers! ENGAGEMENT BEATS VIEWS! I read a recent article by Lea Bardot and it got me to thinking — why can’t I ask for the same engagement on Medium as I am on YouTube? So, for the next little while if you love my content, throw in some claps, drop comments, and feel free to highlight something you love. I will be sure to do the same now that I know what Medium is looking for. Thanks for being awesome! Thanks, Lea for sharing your amazing article to help us all be more successful on Medium!

BACK TO THE ARTICLE!

4) It Can Help Fund Education Or The Purchase Of A Home

The Homebuyer’s Plan (HBP) and Lifelong Learning Plan (LLP) are special features of RRSPs that offer helpful benefits. With the HBP, you can take money out of your RRSP tax-free to use as a down payment on your first home. This helps you become a homeowner without facing immediate taxes. Similarly, the LLP allows you to use RRSP funds tax-free for education expenses, helping you invest in your future without worrying about taxes. These plans give you the flexibility to reach important life goals while using your RRSP savings wisely.

5) Your Investments Aren’t Taxed Along The Way — TAX DEFERRED GROWTH!

Tax-deferred growth is a key advantage of investing in RRSPs — in fact it is probably the most important benefit! When you contribute to your RRSP, your investments grow tax-free until you decide to withdraw them. This means your money can compound over time without being eroded by taxes on capital gains, dividends, or interest each year. Essentially, while your money is sheltered in the RRSP, you’re not subject to the usual taxes that can eat into investment returns in taxable accounts. By harnessing the power of tax-deferred growth in RRSPs, you’re giving your investments the opportunity to flourish without the drag of annual taxes, maximizing your long-term growth potential and building a stronger financial future.

How Much Of A Difference? Its HUGE!

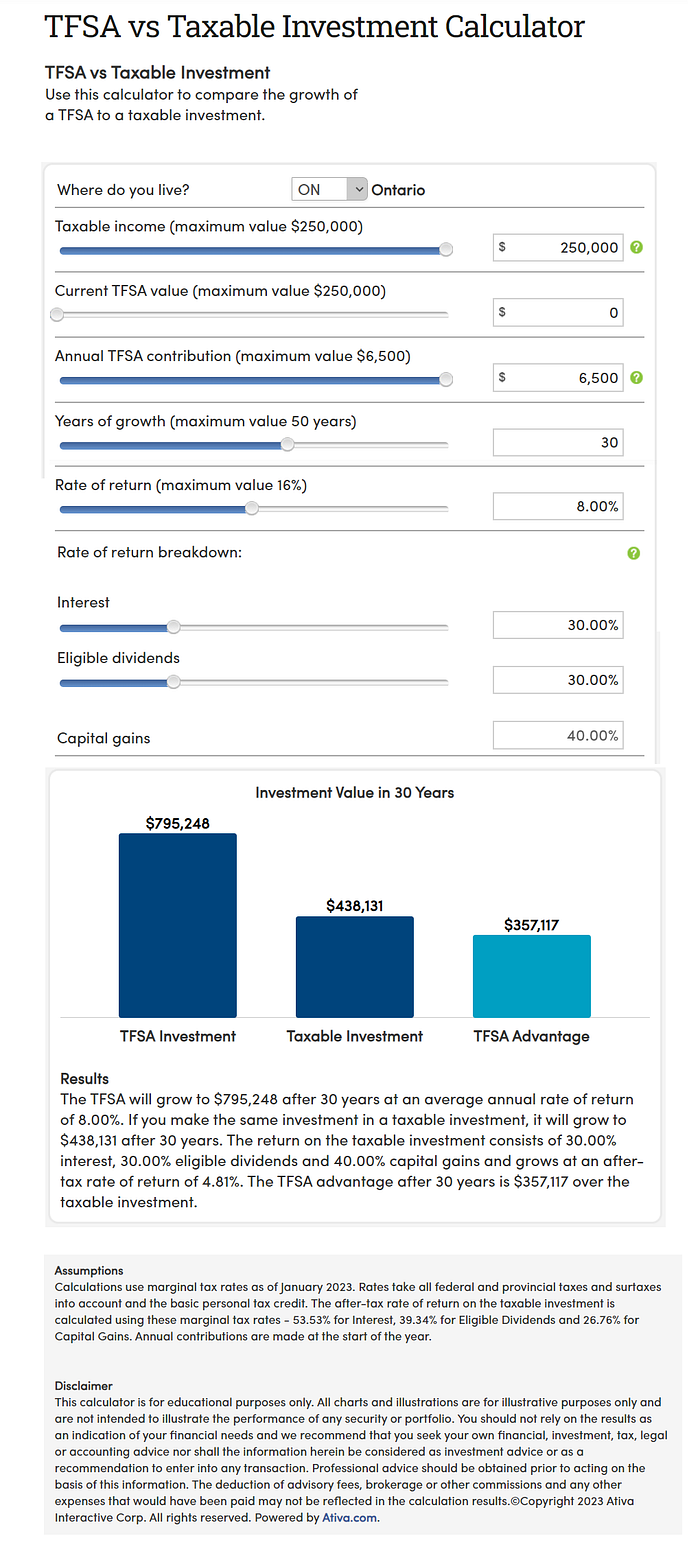

To illustrate the immense impact of tax-deferred growth, I turned to a Tax-Free Savings Account (TSA) versus a taxable investment calculator. Using the top tax bracket in Ontario and an annual contribution of $6,500 to the TSA over 30 years with an 8% rate of return, I employed a standard 70% equity to 30% interest portfolio allocation — 30% Interest, 30% Dividends and 40% Capital Gains.

The results were striking: after three decades, the TFSA ( or tax deferred account ) investment soared to just over $795,000, while the taxable investment lagged significantly behind at just $438,000 — slightly more than half the value of the tax-deferred investment. This stark contrast underscores the power of tax-deferred growth in building wealth over time. Even if one were to withdraw THE ENTIRE RRSP investment in a single year, it would still CLOSELY match the value of the taxable investment. However, it’s worth noting that it’s highly unlikely for retirees to withdraw their entire RRSP investment in one go. This compelling comparison highlights the undeniable advantage of tax-deferred investments in securing a more robust financial future.

The Bottom Line

The comparison between tax-deferred RRSP investments and taxable accounts clearly shows the significant advantage of RRSPs in growing wealth over time. With features like tax-deferred growth and immediate tax deductions, RRSPs offer a straightforward path to building a more secure financial future. So, despite any doubts, it’s evident that RRSPs are not a scam; they’re a smart choice for anyone looking to invest wisely and plan for retirement.

Did you know that navigating the uncertainties of the markets and your finances is generally smoother with the support of an investment advisor or portfolio manager? Studies consistently reveal that individuals who work with investment advisors and portfolio managers tend to have up to three times higher net worth on average, but that’s not all, there’s a significant impact on overall well-being, with those who seek professional advice exhibiting higher levels of happiness and lower anxiety. Having a guiding hand through the financial landscape proves beneficial not only in terms of monetary outcomes but also in fostering a sense of security and contentment, making the challenges of an uncertain year more manageable with professional assistance.

Look No Further, I am A Fiduciary..

However, unraveling the mystery of locating a trustworthy fiduciary advisor proves to be a perplexing task for many. A quick look at common Google searches related to the topic unveils a sense of urgency and a quest for guidance. Phrases like “Fiduciary financial advisors near me,” “Best fiduciary financial advisor,” and “Financial investment advisors near me” are entered into search engines hundreds of times daily, showcasing the widespread need for assistance in finding reliable fiduciary guidance.

Have Questions? Contact us!

We’ve assisted our clients through every stage of life. Even when you’re not aware that something might impact your financial future, it likely will to some extent. Engaging in a conversation with your investment advisor about any financial changes is an excellent approach to keeping your financial goals in focus.

We have expertise in cross-border wealth management for Canadians and US Residents. Don’t hesitate to reach out to us — we’re committed to providing tailored solutions for your cross-border financial needs.

For more information or to connect with me, you can reach out via email at macekadmin@iaprivatewealth.ca or get to know me better by exploring my engaging video content on YouTube

I share valuable insights and discussions on financial planning, market commentary, and investing concepts that can further enrich your understanding. Join me on my channel to discover more!

Don’t hesitate to reach out today at 1–888–324–4259 to discover more about how we can help you achieve your investment milestones.

Joe A. Macek, FMA, CIM, DMS, FCSI

Investment Advisor, Portfolio Manager

iA Private Wealth

Toll Free North America: 1–888–324–4259

Email: macekadmin@iaprivatewealth.ca

238 Portage Ave, 3rd Floor

Winnipeg, Manitoba R3C 0B1

26 Wellington Street East, Suite 700

Toronto, Ontario M5E 1S2

This information has been prepared by Joe Macek who is an Investment Advisor Portfolio Manager for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Investment Advisor Portfolio Manager can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

This platform is solely for informational purposes. Investing involves risk and possible loss of principal capital. Comments by viewers or third-party rankings and recognitions are no guarantee of future investment outcomes and do not ensure that a viewer will experience a higher level of performance or results. Public comments posted on this site are not selected, amended, deleted, or sorted in any way. If applicable, certain editing of personal identifiable information and misinformation may be deleted. This content may be dated.

Sources:

Comments

Post a Comment